dislocated worker fafsa benefits

You are considered a dislocated worker if you. Some of these benefits include.

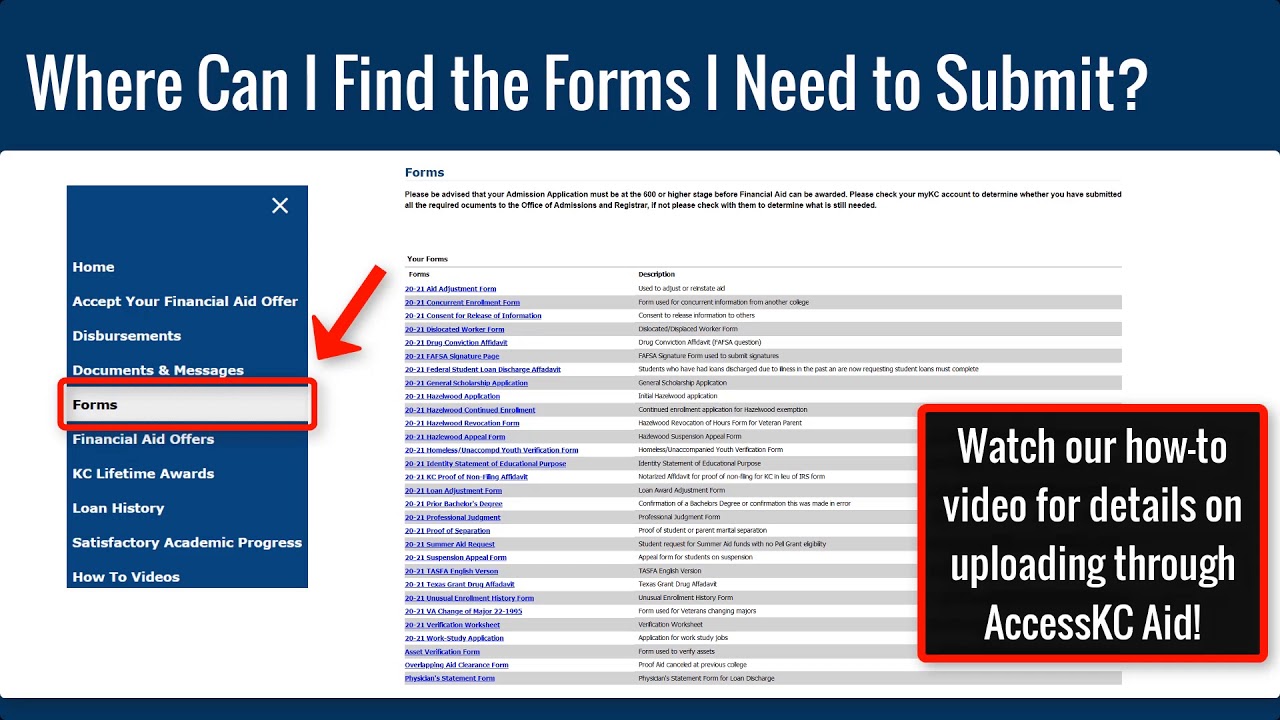

Everything You Need To Know About Applying For Financial Aid

If I say YES to dislocated worker it freezes out Federal Means tested benefits program Free Lunch Program selection and I cannot indicate that we are receiving this.

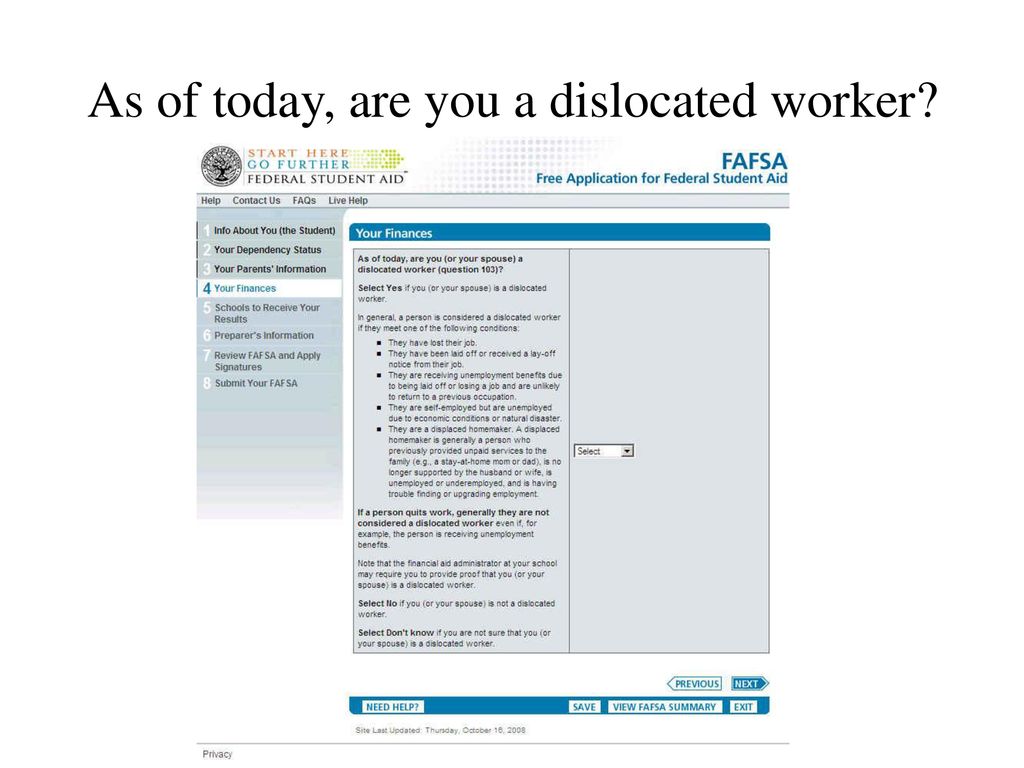

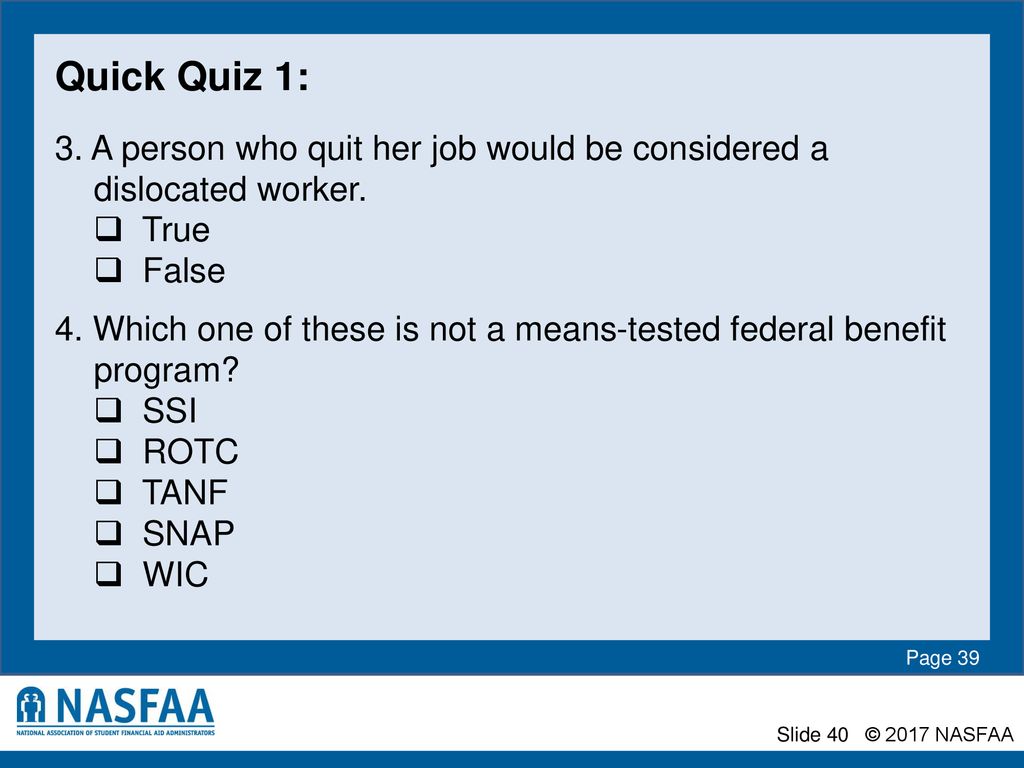

. Pecan Blvd McAllen Texas 78501 PH 9568728375 FAX 9568726461 INSTRUCTIONS On your FAFSA you answered Yes to the. Parents Adjusted Gross Income. Except for the spouse of an active duty member of the Armed Forces if a person quits work generally he or she is not considered a dislocated worker even if for example the person is.

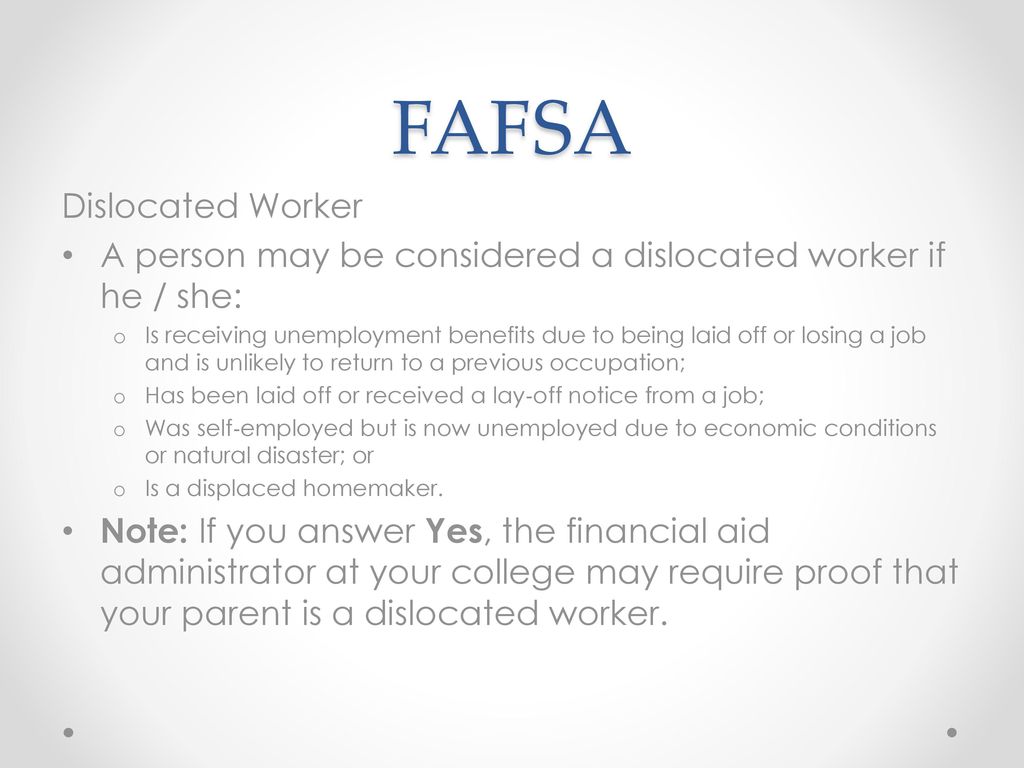

There are several situations when the person is qualified as a dislocated worker at FAFSA. This is question 83 on the paper Free Application for Federal Student Aid FAFSA form. A dislocated worker qualification can lower your EFC and raise the amount of your federal aid award.

Or they have been. Any member of a worker group certified by the Department may be eligible to receive the following benefits and services at a local American Job Center. They might have been laid off from their job.

A student or parents status as a dislocated worker may increase their eligibility for. FAFSA says that anyone who is receiving unemployment benefits because they were laid off fits under the umbrella of a dislocated worker. Is receiving unemployment benefits.

A person may be considered a dislocated worker if he or she. Is or was receiving unemployment benefits due to being laid off or losing a job. What are displaced worker benefits.

FAFSA considers you a dislocated worker if you lost your job or got laid off for a reason beyond your control and you dont expect to be able to work in that same role or. Firstly it refers to those who are currently receiving unemployment benefits. Any member of a worker group certified by the Department may be eligible to receive the following benefits and services at a local.

Training Employment Case management services Relocation allowances Income support Job search allowances. Student Financial Services K 1700 3201 W. Yes means the students parent is a dislocated worker as of the date the FAFSA was completed and the student may qualify for the simplified needs test or for an automatic zero Expected.

You must still report all income taxed and. Are a displaced homemaker stay-at-home student who. A parent may be considered a dislocated worker if he or she.

To be a dislocated worker on FAFSA your parent or guardian must be unemployed under certain conditions. Dislocated workers are students or their parents who lost employment through no fault of their own. I was furloughed in March 2020 of my job due to.

Have been laid off. Does being a dislocated worker affect FAFSA. What are dislocated worker benefits.

Are receiving unemployment benefits as a result of being laid off.

Fafsa On The Web For Effective January 1 Ppt Download

A Fumble On A Key Fafsa Tool And A Failure To Communicate The New York Times

Senior College And Financial Aid Night Ppt Download

Announcements And Financial Aid Semester Calendar Financial Aid Welcome To The Mycharteroak Student Portal

Fsa Training Conference Program Information

Does Being A Dislocated Worker Affect Fafsa Zippia

11 26 Financial Aid High School Presentation Presenter Thomas D Foga Associate Director Of Financial Aid The College Of New Jersey New Ppt Download

Fafsa Basics Parent Assets The College Financial Lady

Indiana Student Financial Aid Association Isfaa Financial Aid

What Is A Dislocated Worker On The Fafsa Scholarships360

How To Make Your Assets Disappear On The Fafsa

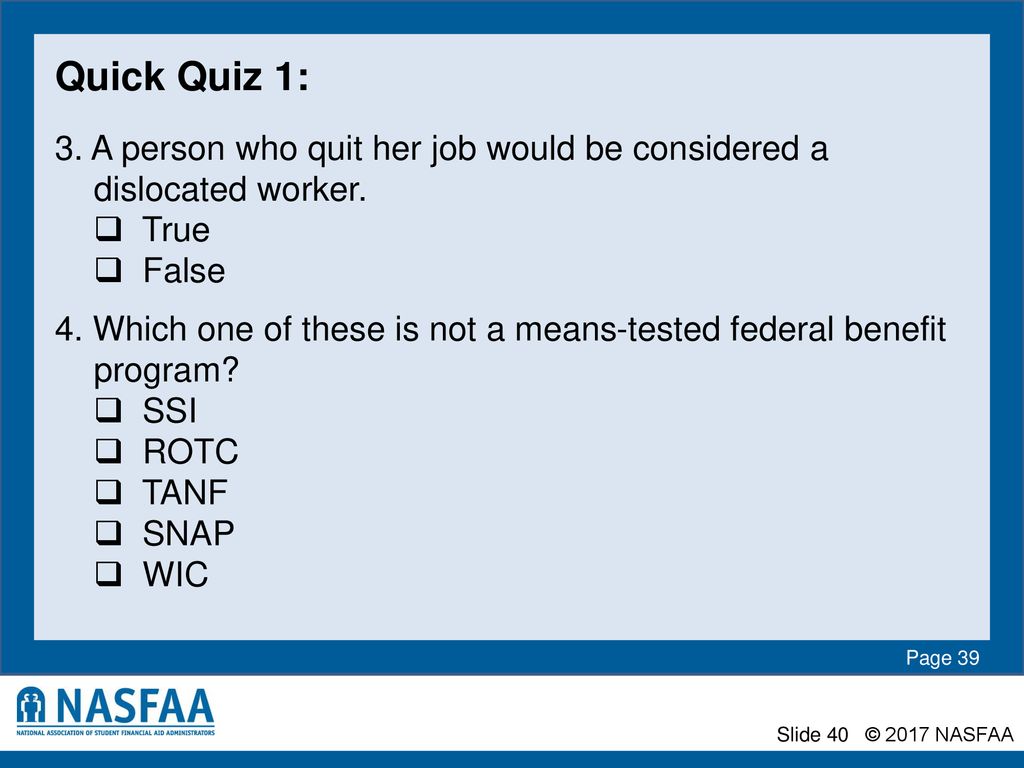

The Application Process A Nasfaa Authorized Event Presented By Name Of Presenter Association Location Date Ppt Download

How To Answer Fafsa Question 92 96 Student Federal Benefit Status

How To Answer Fafsa Question 97 Dislocated Worker Status